South Africa, Morocco, Algeria, Kenya lead region

Internet speed in Nigeria ranks low among the leading 15 markets on the continent, market analysis has revealed.

According to the analysis from OpenSignal, a global provider of independent insights, South Africa, Morocco, Algeria and Kenya rank higher than the country.

Basing its results on the data collected from March 1 to May 29, it gathered that Internet Download Speed in Nigeria is 14.6Mbps as against South Africa’s 27.3Mbps; Morocco, 23.4Mbps; Egypt, 16Mbps and Kenya, 14.6Mbps.

Behind Nigeria are Tanzania with 13.6Mbps, Côte d’Ivoire, 13Mbps; Algeria, 11.7Mbps; DRC, 11.3Mbps; Uganda 9.3Mbps; Ghana 8.6Mbps; Cameroon, 8Mbps; Angola 7.6Mbps; Ethiopia, 6.4Mbps and Sudan, 5.7Mbps.

In terms of uploading, Morocco’s upload speed was 7.6Mbps; Algeria, 6.2Mbps; South Africa, 5.8Mbps; Kenya, 5.7Mbps; Egypt, 5.4Mbps and Nigeria, 4.9Mbps.

Talking about the consistent quality of mobile experience, subscribers in South Africa with 50.9 per cent lead the continent as users with better mobile experience. Egypt is second with 46 per cent; Morocco, 45.3 per cent; Kenya, 44.4 per cent and Tanzania, 38.6 per cent. Others are Algeria with 37.7 per cent; DRC, 25.4 per cent; Angola, 22.1 per cent; Uganda, 18.1 per cent and Nigeria, 10.9 per cent.

While the report explained that smartphone users in South Africa enjoyed the most consistent mobile network experience in Africa as the market leads with a score of 50.9 per cent, ahead of others, these scores, it said reflected the percentage of tests in which smartphone users’ experience on a network is sufficient to support the requirements of more common demanding applications, such as video calling, uploading an image to social media, or using smart home applications.

It stressed that the tests combined different experience indicators such as download speed, upload speed, latency, jitter, packet discard, and time to first byte.

According to it, in Ghana, Sudan, and Côte d’Ivoire, the percentage of successful tests was below 10 per cent, with Ethiopia and Cameroon scoring as low as 0.1 per cent. Opensignal said these relatively low scores are likely due to the high usage of old 3G technology in those markets.

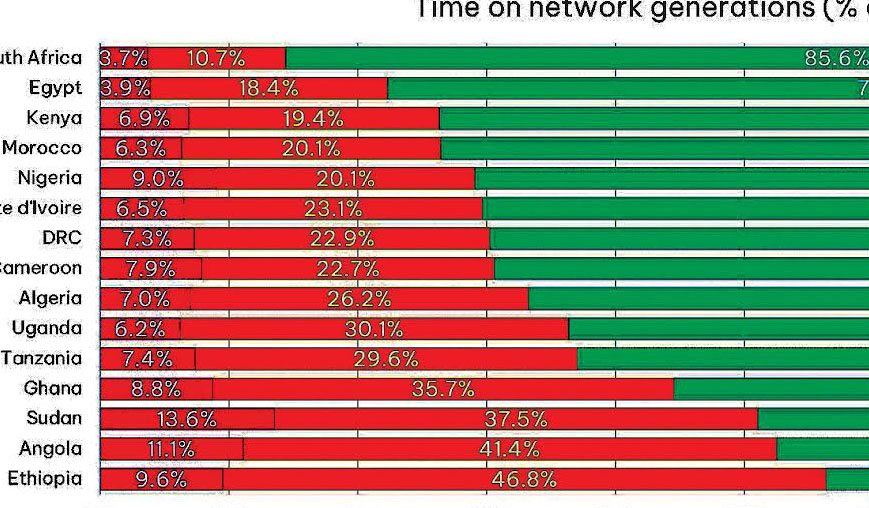

Further, the report noted that slower speeds and worse experiential scores for some African markets are because smartphone users in those markets still spend a large proportion of time connected to older network generations — like 3G, or even 2G — that are much less capable than 4G.

It said smartphone users in Ethiopia and Angola where mobile experience scores tend to be low spend more than 40 per cent of their time connected to 3G services. By contrast, users in Uganda, Ghana, and Sudan — more than 30 per cent of the time.

According to it, limited spectrum bandwidth, together with heavy use of 3G connectivity and lower maximum data transfer rates adversely affects the quality of the overall mobile network experience in African markets.

It stressed that even 2G is still notable in some African markets, “for example, our smartphone users spend more than five per cent of their time connected to 2G in Angola, Ethiopia, Ghana, Nigeria, Sudan, and Tanzania. However, in South Africa and Morocco, users spend just 1.9-2 per cent of their time on 2G. Notably, our smartphone users in Sudan, Morocco, Angola, and Cameroon spend the highest proportion of time with no signal among African markets, ranging from 3.3 to 4.9 per cent of the time, which makes connecting to mobile services even more challenging.

The report said the extent of 3G usage is due to the cost of mobile infrastructure (backhaul, security at base stations), energy (fuel and generators) and local deployment regulator fees — along with many users still reliant on older and simpler mobile devices, not enabled for newer generations.

Opensignal said Solar-power cells are one of the potential solutions for deploying base stations in remote areas, while the production of low-cost and more affordable smartphones can help users access mobile services more easily and boost their experience when using the Internet for work, education, and entertainment.

The report observed that for many Internet users worldwide, especially in low and middle-income markets, mobile connectivity is the main — and often only — means of access. This is due to the limited access to relatively costly fixed broadband Internet services, especially in rural and remote areas.

Opensignal said its data demonstrated that in many African markets, users connect to Wi-Fi services very sporadically, “our smartphone users spend only 8.7 per cent of their time on Wi-Fi in Sudan, 11.9 per cent in Ghana, and 12.5 per cent in the Democratic Republic of the Congo. On the other hand, smartphone users in South Africa spend the most time on Wi-Fi across the observed markets — 58.6 per cent — followed by Egypt with nearly half of the time connected to Wi-Fi services. These are average values across all smartphone users.

Speaking on 5G, the report noted that several markets in Africa have already deployed 5G networks, like South Africa, Nigeria or Kenya. The presence of 5G connectivity is poor on the continent, with only South Africa having a more substantial number of 5G subscriptions, while others observe only several thousand of 5G users.

It pointed out that further development of seamless and reliable mobile connectivity in Africa is essential for the markets’ economic growth, especially given the high numbers of mobile-only users.

According to it, the road to ubiquitous 5G in Africa is likely to be a long one, as access to 4G is still not universal and many users still rely on 2G and 3G networks to connect to the mobile Internet.