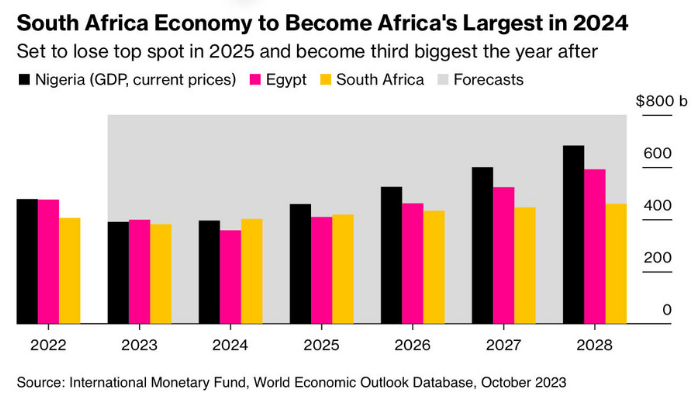

South Africa is set to briefly overtake Nigeria and Egypt as the continent’s largest economy next year, International Monetary Fund forecasts show.

The IMF’s World Economic Outlook envisions South Africa’s gross domestic product reaching $401 billion based on current prices in 2024, compared with Nigeria’s $395 billion and Egypt’s $358 billion. Africa’s most industrialized nation is expected to only hold the top spot for a year before it once again lags Nigeria, and then fall to third place behind Egypt in 2026, according to the report, which was released last week.

While IMF data shows Nigeria’s economy has eclipsed South Africa’s since 2018, its fortunes have dimmed along with a decline in production of oil and it has been grappling with runaway inflation and a plunge in the value of the naira.

According to Bloomberg economists, ““We believe the IMF’s projections reflects where it believes meaningful reforms will take place. South Africa’s transient emergence as Africa’s largest economy in 2024 is mainly due to the shrinking of Nigeria and Egypt’s GDP in dollar terms, following sharp currency devaluations. However, the long-term trajectory shows Nigeria and Egypt regaining their top spots, with the former taking a strong lead. For Nigeria to realise the GDP expansion projected by the IMF, we think oil output must be restored to its potential; insecurity needs tackled; and the bottlenecks in the power sector addressed.”

Bola Tinubu has announced significant policy changes aimed at getting the state’s finances back on track since he became president of the West African nation at the end of May, including revamping the foreign-exchange system, scrapping costly gasoline subsidies and taking steps to address dollar shortages and boost tax revenue.

Read also: Moghalu slams FG over $1.5bn World Bank loan

Those measures are causing initial pain in Africa’s most populous nation, but are expected to increasingly pay dividends going forward. The IMF sees GDP expanding 3.1% next year, compared with 2.9% in 2023.

The reforms should lead to “stronger and more inclusive growth,” Daniel Leigh, division chief in the IMF’s research department, told reporters at the fund’s annual meetings in Marrakech, Morocco, last week.

Egypt has devalued its currency three times since early 2022 as it confronts a foreign-exchange crunch, with the pound losing almost half its value against the dollar.

The government secured a $3 billion IMF package last year that requires a more flexible exchange rate, a move it’s only likely to undertake after December elections in which President Abdel-Fattah El-Sisi is seeking to extend his rule until 2030.

The delay has stalled IMF reviews that were initially scheduled for March and September. Successful appraisals could unlock about $700 million in postponed loan tranches, give Egypt access to a $1.3 billion resilience fund and potentially spur major Gulf investments.

Read also: Nigeria’s economy will begin an upward swing if the policies are properly implemented – Uviase

The government is meanwhile in talks with the IMF on boosting its rescue package to more than $5 billion, according to people familiar with the discussions, confident it can overcome the hurdles preventing it from accessing support, including addressing concerns over its currency policy. The implementation of a reform agenda could underpin an economic growth rate of 5% or more from 2026, according to the IMF.

Unlike Nigeria’s naira and Egypt’s pound, South Africa’s rand is free floating, and has lost about 10% of its value against the dollar this year.

Currency weakness has been stoked by concerns that the National Treasury will miss its budget deficit and debt-to-GDP targets for the fiscal year through March due to increased demands on the state for support and revenue shortfalls, as a fraying transport network and record power cuts curtail economic growth.

The IMF sees South Africa’s economy expanding 0.9% this year and 1.8% in 2024, with the potential to expand 2.5% to 3% faster should it improve the power situation, tackle logistic bottlenecks and institute other reforms.