Nigerian banks are expanding their reach across the continent through a series of acquisitions of smaller banks, in a drive to dominate the African financial landscape, BusinessDay’s findings have revealed.

Nigerian banks have been expanding their operations in Africa, either organically or through acquisitions, and have seen significant progress in recent years.

This expansion has given them a strong presence in key African markets and access to growing economies.

According to Sesan Adeyeye, portfolio manager at Asset & Resource Management Holding Company (ARM HoldCo), the primary factors driving Nigerian banks’ expansion into the African market are valuation, global reach, and partnerships.

“Expanding into African countries improves banks’ valuation by increasing their presence across the continent. It also brings diversification benefits, synergistic advantages, and revenue stability, enabling them to extend their services beyond core banking offerings,” Adeyeye said.

The rise of pan-African banks, as noted by the International Monetary Fund (IMF), is a testament to the increasing economic integration across the continent, offering numerous opportunities and advantages.

“Moreover, this expansion provides increased reach and valuable partnerships, especially during a period when the African Continental Free Trade Area (AFCFTA) has been in focus,” Adeyeye added.

Some Nigerian banks have pursued organic growth by establishing subsidiaries in foreign countries and growing them from scratch, while others have opted for inorganic expansion through mergers and acquisitions.

Tesleemah Lateef, a research Analyst at Cordros, pointed out that the expansion of Nigerian banks into the African market is not driven by any specific major reason.

“Instead, most of these banks have it stated in their objective plan to expand to the African market as a growth initiative, not necessarily for immediate profit,” Lateef said.

According to Lateef, “The management sees the expansion as a positive step that aids in diversification.

“By expanding, banks are not only growing but also able to diversify their operations. This diversification serves as a protective measure against shocks, which is another reason why Nigerian banks are making strides in the African market,” Lateef said.

In recent years, Nigerian banks have demonstrated aggressiveness in expanding their footprint across Africa, often acquiring or merging with smaller banks in various African countries.

For instance, Access Bank, a major Nigerian bank, has recently acquired five subsidiaries of Standard Chartered in African countries, expanding its presence in Angola, Cameroon, The Gambia, and Sierra Leone, as well as its consumer, private, and business banking business in Tanzania.

“By expanding into other African countries, Nigerian banks demonstrate their commitment to growth and appeal to potential investors, this strategy prevents them from relying solely on the Nigerian market,” Adeyeye said.

Lateef noted that the approach to expansion differs among banks, depending on their management style. Some banks exhibit more aggressive tactics, while others take a more conservative approach. This can be observed in the pace at which Access Bank is pursuing its expansion strategy.

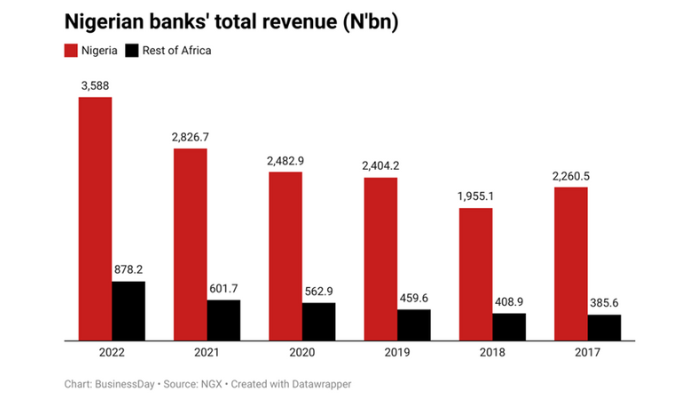

Analysis by BusinessDay shows that Nigerian banks with operations in African countries, including First Bank, UBA, GTco, Access, and Zenith Bank, recorded N3.59 trillion in revenue from their Nigerian subsidiaries in comparison to N2.83 trillion in 2021.

Additionally, N878.19 billion was recorded from their other subsidiaries in the rest of Africa, compared to N701 billion in 2021.

In terms of their revenue, Adeyeye noted that most of their revenue is gotten from Nigeria, but there is reduced concentration risk on the Nigerian market alone.

Read also: eTranzact grows profit after tax by 157.8%

While the pace and approach of continental expansion vary among different Nigerian banks, venturing into other African markets enables them to diversify assets and balance profitability against results in Nigeria, despite the challenges and benefits that come with it.

Zenith Bank, Guaranty Trust Holding Company Plc (GTCO), United Bank of Africa (UBA), Ecobank, and Access Holding Plc collectively incurred impairment costs of N320 billion at the beginning of the year, according to BusinessDay’s calculation.

“Lately, the global market has experienced volatility, especially in emerging markets. Some countries, like Ghana, have faced financial instability, attracting attention at the beginning of this period. However, such instances are not unique, and despite the challenges, banks remain hopeful that stability will eventually return leading to more investment across the board,” Adeyeye said.

Lateef stated that the diversification of shocks allowed Nigerian banks to withstand the impacts of the Ghanaian bonds’ shocks.

“Regarding competition, if the benefits outweigh the costs, it is anticipated that more Nigerian banks will enter the African market, especially since Access Bank is setting the pace,” Lateef said.

Access Holdings Plc

Access Holdings Plc, is a multinational commercial bank established in 1989. It operates subsidiaries in various African countries, including the Democratic Republic of the Congo, Ghana, Kenya, Nigeria, Rwanda, Gambia, Sierra Leone, South Africa, Zambia, and the United Kingdom.

In 2022, Access Bank Group earned N1.13 trillion in revenue from its Nigerian operations and N206.65 billion from its subsidiaries in the rest of Africa.

In 2021, it generated N734.3 billion from its Nigerian subsidiary and N82.8 billion from the rest of Africa.

In 2020, Access Bank Group recorded N635.6 billion in revenue from Nigeria and N89 billion from the rest of Africa.

In 2019, the bank’s Nigerian subsidiary brought in N572.06 billion, while the subsidiaries in the rest of Africa collectively earned N61.7 billion.

In 2018, the Nigerian subsidiary contributed N212.6 billion to the bank’s revenue, and the rest of the African subsidiaries contributed N29.8 billion.

In 2017, the Nigerian operations earned N398.1 billion, and the subsidiaries in the rest of Africa made N38.7 billion.

In terms of customer deposits, Access Bank’s Nigerian operations had N7.53 trillion in 2022, while the rest of Africa’s subsidiaries accumulated N1.14 trillion in customer deposits.

Zenith Bank Plc

Zenith Bank Plc was founded in 1990, operating from more than 500 branches and business offices across Nigeria. The bank also has subsidiaries in Ghana, Sierra Leone, Gambia, and South Africa.

In 2022, Zenith Bank recorded N844.97 billion in revenue from its Nigerian operations and N79.65 billion from its subsidiaries in the rest of Africa.

In 2021, it earned N688.16 billion from Nigeria and N74.7 billion from the rest of Africa.

In 2020, Zenith Bank’s Nigerian operations generated N606 billion in revenue, while its rest of Africa subsidiaries made N74.6 billion.

In 2019, Zenith Bank’s Nigerian subsidiary earned N575.07 billion, and the rest of Africa’s subsidiaries recorded N68.23 billion.

In 2018, the Nigerian operations brought in N548.3 billion, and the rest of Africa’s subsidiaries made N68.5 billion.

In 2017, Zenith Bank’s revenue from its Nigerian subsidiary was N684 billion, while the rest of Africa’s subsidiaries made N53.8 billion.

In 2022, Zenith Bank’s profit after tax was N239.73 billion in Nigeria and a loss of N16.55 billion in the rest of Africa.

The bank’s total assets amounted to N7.43 trillion in Nigeria and N436.541 billion in the rest of Africa in 2022.

FBN Holdings Plc

FBN Holdings Plc, formerly known as First Bank of Nigeria, was founded in 1894 and specializes in retail banking. It has a presence in the Republic of Congo, Ghana, The Gambia, Guinea, Sierra Leone, and Senegal.

In 2022, FBN Holdings earned N667.21 billion in revenue from Nigeria and N137.91 billion from its subsidiaries outside Nigeria.

In 2021, it generated N699.8 billion from Nigeria and N57.44 billion from the rest of Africa.

In 2020, the Nigerian operations brought in N505.9 billion, and the rest of Africa’s subsidiaries made N84.66 billion.

In 2019, the Nigerian subsidiary recorded N506.3 billion in revenue, while the rest of Africa’s subsidiaries earned N84.1 billion.

In 2018, the Nigerian operations contributed N499.15 billion, and the rest of Africa’s subsidiaries made N88.25 billion.

In 2017, FBN Holdings earned N508.2 billion from its Nigerian subsidiary and N87.25 billion from the rest of Africa.

In 2022, the bank’s non-current assets in Nigeria were N96.77 billion, compared to N28.39 billion from its subsidiaries outside Nigeria.

United Bank for Africa

United Bank for Africa (UBA) was founded in 1949 and has a presence in several African countries.

In 2022, UBA’s revenue from its subsidiaries in the rest of Africa was N327.03 billion, while the revenue from Nigeria amounted to N543.75 billion.

In 2021, it earned N372.7 billion from Nigeria and N275.5 billion from the rest of Africa.

In 2020, UBA’s Nigerian operations generated N372.2 billion in revenue, while the rest of Africa’s subsidiaries earned N227.45 billion.

In 2019, the Nigerian operations contributed N403.2 billion, and the rest of Africa’s subsidiaries made N166.2 billion.

In 2018, UBA’s Nigerian subsidiary earned N338.8 billion, and the rest of Africa’s subsidiaries made N152 billion.

In 2017, UBA Nigeria recorded N314.5 billion, while the rest of Africa’s subsidiaries earned N150.7 billion.

UBA’s customer and bank deposits amounted to N5.29 trillion in Nigeria, and the rest of Africa’s subsidiaries recorded N23.29 trillion in 2022. Total segment assets for UBA in Nigeria stood at N6.73 trillion, while the rest of Africa’s subsidiaries totalled N3.92 trillion in 2022.

Guaranty Trust Holding Company

Guaranty Trust Holding Company (GTCO Plc) was established in January 1990 and has subsidiaries in several African countries, including Cote D’Ivoire, Gambia, Ghana, Liberia, Kenya, Rwanda, Tanzania, Uganda, and Sierra Leone, as well as the United Kingdom.

In 2022, GTCO’s revenue from Nigeria was N401.95 billion, and the rest of Africa’s subsidiaries contributed N126.95 billion.

In 2021, it earned N331.7 billion from Nigeria and N111.3 billion from the rest of Africa.

In 2020, GTCO’s Nigerian operations generated N363.2 billion, while the rest of Africa’s subsidiaries earned N87.22 billion.

In 2019, the Nigerian operations contributed N347.6 billion, and the rest of Africa’s subsidiaries made N79.4 billion.

In 2018, GTCO’s Nigerian subsidiary earned N356.2 billion, and the rest of Africa’s subsidiaries made N70.34 billion.

In 2017, GTCO Nigeria recorded N355.7 billion, while the rest of Africa’s subsidiaries earned N55.17 billion.

Total assets stood at N5.17 trillion for GTCO in Nigeria, while N733.24 billion was accounted for in its subsidiaries in the rest of Africa in 2022.