The African Private Equity and Venture Capital Association (AVCA), the pan-African industry body which promotes and enables private investment in Africa, has released the 2021 edition of the African Private Equity report, showing an insightful analysis of the industry.

Known as the Annual African Private Equity Data Tracker, the report provided insights on private equity fundraising, deals, and exits, among others.

Here are key insights BusinessDay extracted from the report.

Total value grew by 4x

In 2021, private capital fund managers continued to successfully close funds targeting investments across different strategies, sectors and regions within Africa.

Specifically, in 2021 the total value of Africa’s private capital fundraising grew 4x the level of 2020, and reached $4.4bn. Infrastructure and Growth Capital fundraising reached record levels in 2021, representing 45percent and 36percent respectively of the total value of final closed funds in Africa.

Over half (59%) of the total fundraising value originated from sector-specific funds – investing in sectors such as renewable energy, technology, and agribusiness.

“Overall, the varied strategies adopted by private capital fund managers through the years have significantly helped Africa’s private capital landscape to broaden and deepen,” AVCA said.

Venture capital accounts for the lion’s share

The AVCA’s report found that 54percent of the total deal value reported in 2021 were venture capital investments. AVCA’s ‘Venture Capital in Africa Report’, released alongside the private capital report, found that 604 African startups had raised a total of $5.2 billion in Africa last year.

Some of the biggest deals included a $400 million Series C investment round by the Nigeria-based payments company OPay and a $200 million Series A round by the Senegal-based mobile money company Wave.

Read also: Private equity sector set to take off in Africa, says Carlyle

“Most of the value came from 16 “super-sized deals” that raised a total of $2.6 billion,” AVCA’s report said.

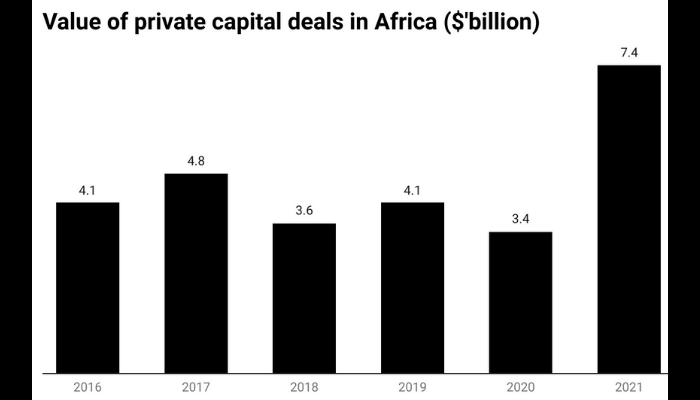

Private capital deals soar

The volume of private capital deals recorded in Africa, in 2021, reached a record high of 429, with the total deal value also being the highest on record at $7.4bn. Venture capital super-sized deals (deals above $100mn) significantly contributed to this deal value increase, accounting for 32percent of the total investment value.

Overall, investments in early-stage companies gained significant momentum attracting 54percent ($4bn) of the total value reported on the continent last year.

From a regional perspective, West Africa attracted the largest share of deal volume at 33percent, while large multi-region deals with operations across different regions within Africa accounted for the largest share by value (40%).

Exits increases by 13 percent

In 2021, the number of exits increased by 13 per cent to 36 from 32 in 2020. Sales to trade buyers were the most common exit route (50%) on the continent last year, whereas exits to PE and other financial buyers came second, representing a 31percent of the total number of exits in 2021. Exits by public offering accounted for 3 percent of the total volume of exits reported on the continent last year.

A notable example is Amethis’ exit from Velogic, a leading transport and logistics company based in Mauritius, through an IPO on the Development & Enterprise Market of the Stock Exchange of Mauritius.

Nigeria dominates VC funding

The deal volume reported in West Africa was dominated by Nigeria, which concentrated 69percent of the region’s total deal volume in 2021. Africa’s biggest economy was followed by South Africa, Egypt, Kenya, Senegal, Ghana, and Algeria respectively.

For instance, some of the biggest deals in 2021 include a $400 million Series C investment round by the Nigeria-based payments company OPay and a $200 million Series A round by the Senegal-based mobile money company Wave.

Another notable deal was when MasterCard scaled up its minority stake in Airtel money by $25 million alongside TPG, a US private equity firm, and Qatar Investment Authority, each raising its interest by $50 million in November 2021. That puts the combined investment of the three companies in the wireless operator at $500 million since the start of the year.

Fintech is funder favourite

The report noted Fintech is by far the largest and most well-funded sector in Nigeria, operating as a base for pan-African giants such as Flutterwave, Paystack, Interswitch, and Paga.

The sector was responsible for 38percent of all deals between 2014 and 2021 followed by consumer discretionary (16%), information technology (12%), industrials (12%) and communication services (7%).