More women own businesses than men in the U.S.-African immigrant communities of Minneapolis–Saint Paul, however, women say they have fewer financial assets than men, according to a new study.

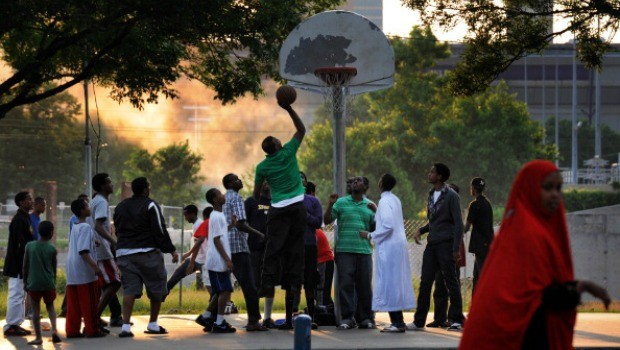

The Twin Cities are home to thousands of immigrants and refugees, many of them from Cameroon, Eritrea, Ethiopia, Liberia, Nigeria and Somalia, MinnPost reports.

Many arrived in the northern U.S. area fleeing civil war or political persecution. Others came for the opportunity to study or work.

At least 73,000 African immigrants call Minnesota home, according to the 2008-2012 American Community Survey, TwinCities reported. With children included, that number is closer to 111,000, although advocates say a more accurate figure could be double that.

The immigrants come from at least 25 African countries, making Minnesota home to the ninth-largest African community in the U.S., according to TwinCities.

About 60 percent of the Twin Cities African migrant population comes from East African countries such as Ethiopia and Somalia, and 25 percent from West African countries such as Nigeria and Liberia. The rest come from throughout the continent. About one in five immigrants in Minnesota is African, according to the U.S. census, TwinCities reported.

Bruce Corrie, an economics professor at Concordia University in St. Paul, has been tracking the economic growth of these communities for years, studying their economic power and growing entrepreneurship along with obstacles they face.

In his latest report, “The Economic Potential of African Immigrants in Minnesota,” MinnPost said Corries puts the African migrant community’s purchasing power at $1.6 billion a year. In the Twin Cities metro area alone, African immigrants spend $800 million a year on groceries, electronics, furniture and healthcare, among others, Corrie said.

The report is funded by the McKnight Foundation, a Minnesota foundation working to strengthen communities. Information is based on 600-plus customer and business surveys.

Among other things, the study compared male and female African immigrant entrepreneurs and looked at their financial assets, business skills and civic involvement, MinnPost reported.

The report said that African migrant women have a more difficult time selling their business ideas compared to men. When it comes to licensing and regulation knowledge, men are way ahead of women.

From MinnPost. Story by Ibrahim Hirsi.

But women are more active in civic involvement, including voting, volunteering and participating in their children’s school activities: About 65 percent of African immigrant men voted in 2014 compared to nearly 80 percent of women.

Likewise, nearly 74 percent of African immigrant women volunteered and 64 percent participated in school activities compared to 70 percent of men who volunteered and about 56 percent who participated in school activities with their children.

The two groups, however, have one thing in common: Most of them use informal financial networks to fund their businesses, the study stated.

“The survey shows strong usage of community loan pools for financing business enterprises,” he wrote. “This is a very effective way for financing in immigrant communities.”

Still, Corrie wrote, there’s a room for improvement: “Support efforts to develop these alternative loan pools and to provide risk management tools for these loan funds.”

Source: MinnPost